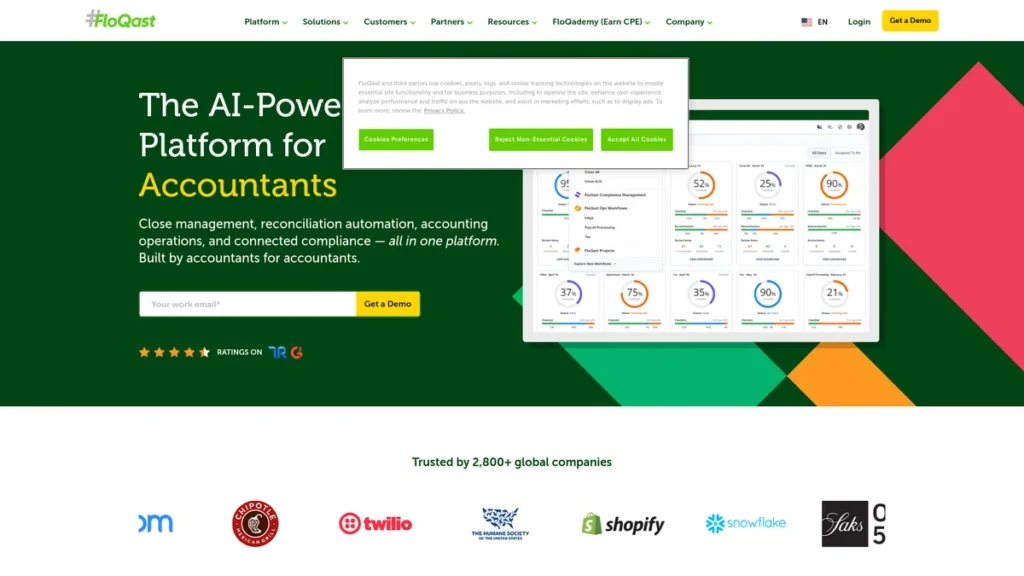

What is FloQast?

FloQast is a cloud-based accounting workflow automation platform designed to help finance teams close their books faster and more accurately. For a fast-moving marketing manager, this isn’t just back-office jargon; it’s a direct catalyst for agility. When your finance department can reconcile accounts and finalize reports in record time, you get access to crucial campaign performance data, budget actuals, and ROI calculations days or even weeks sooner. This speed transforms your ability to pivot strategy, reallocate ad spend, and justify budget requests with up-to-the-minute data. FloQast acts as the engine for the finance team, providing the marketing department with the high-octane data needed to drive decisions.

Key Features and How It Works

FloQast centralizes and automates the historically manual and error-prone process of the financial close. It integrates directly with a company’s Enterprise Resource Planning (ERP) system to streamline operations.

- Automated Reconciliation: The platform’s AI-driven engine automatically matches transactions, significantly reducing the manual effort required to tie out accounts. This means discrepancies in vendor payments or ad spend are flagged and resolved faster, ensuring your budget reports are built on solid ground.

- Close Management: Think of this as the mission control for your financial close, similar to how a marketing team uses a project management dashboard to track a campaign launch. It provides a centralized, real-time checklist of all tasks, deadlines, and ownership. This transparency allows stakeholders, including marketing leaders, to see progress and anticipate when financial data will be available.

- ERP Integration: FloQast doesn’t replace your company’s core financial system (like NetSuite, Oracle, or SAP); it enhances it. By sitting on top of the ERP, it pulls data directly, ensuring everyone is working from a single source of truth and eliminating version control issues common with offline spreadsheets.

- Collaboration Tools: Built-in communication and review features keep accounting teams aligned. This reduces bottlenecks and endless email chains, further accelerating the close process and, by extension, the delivery of critical financial insights to departments like marketing.

Pros and Cons

FloQast presents a compelling case for streamlining financial operations, but it’s essential to weigh its advantages and potential drawbacks.

Pros

- Accelerated Data Availability: The primary benefit for marketing is speed. A faster financial close directly translates to quicker access to finalized campaign spending and performance metrics.

- Improved Data Accuracy: Automation minimizes the risk of human error in financial reports, providing you with more reliable data for calculating customer acquisition costs (CAC) and campaign ROI.

- Enhanced Visibility: Centralized dashboards offer unprecedented transparency into the close process, helping you better forecast when to expect critical budget-to-actual reports.

- Scalable Workflows: As your marketing budget and campaign complexity grow, FloQast scales with the finance team’s needs, ensuring processes don’t break under pressure.

Cons

- Indirect Impact: As a marketing manager, you are a beneficiary of FloQast, not a direct user. The value is contingent on the finance team’s successful adoption of the platform.

- Potential High Cost: The platform’s pricing structure may be a significant investment, potentially competing for budget resources with other tools in the marketing tech stack.

- Implementation Time: While it boosts long-term efficiency, there is an initial learning curve and setup period for the accounting team, which might temporarily delay processes before accelerating them.

Who Should Consider FloQast?

FloQast is most impactful for marketing departments within mid-to-large-sized companies where financial complexity and reporting demands are high. If your team is part of a rapidly scaling organization, a public company with stringent audit requirements, or an agency managing significant client ad spend, the tool is a strategic asset. It’s particularly valuable for remote or distributed teams that need a centralized platform to coordinate complex financial workflows. Essentially, if your marketing team’s agility is frequently hampered by waiting for the books to close, advocating for FloQast in your finance department could be a game-changing move.

Pricing and Plans

Detailed pricing information for FloQast plans was not publicly available. The cost is typically customized based on the size of the company, the number of users, and specific feature requirements. For the most accurate and up-to-date pricing, please visit the official FloQast website.

What makes FloQast great?

Ever find yourself waiting weeks for the finance team to close the books before you can get accurate campaign ROI figures? FloQast directly addresses this critical pain point by unifying close management, reconciliation, and collaboration into a single, cohesive platform. Its key differentiator is its deep, seamless integration with existing ERPs. Unlike solutions that operate in a silo, FloQast leverages the company’s central financial data source, enhancing it with powerful automation and workflow management. This approach creates a streamlined, auditable, and highly efficient ecosystem that transforms the financial close from a slow, manual marathon into a quick, automated sprint, delivering the data marketing teams need to stay ahead.

Frequently Asked Questions

- How can FloQast help my marketing team if we don’t use it directly?

- By empowering your accounting team to close the books faster and with greater accuracy, FloQast ensures you receive critical financial data—like budget actuals and campaign spend reports—much sooner. This accelerates your ability to analyze performance and make informed strategic decisions.

- Does FloQast integrate with marketing tools like our CRM or ad platforms?

- FloQast’s primary function is to integrate with ERP and financial systems like NetSuite, SAP, and Oracle. While it may not connect directly to platforms like HubSpot or Google Ads, its API offers potential for custom integrations. The main benefit comes from its ability to quickly reconcile the financial data originating from those platforms within the ERP.

- Is FloQast only for large enterprise marketing departments?

- While it is highly effective for large enterprises, FloQast is also designed for mid-sized and rapidly growing companies. If your marketing budget is becoming more complex and the demand for fast, accurate reporting is increasing, FloQast’s scalable platform can provide significant value.

- Can FloQast improve the tracking of marketing spend?

- Indirectly, yes. FloQast automates the reconciliation of company-wide accounts. This means any invoices or credit card charges related to ad spend, software subscriptions, or agency fees are matched and verified more efficiently by the finance team, leading to a faster and more accurate picture of the marketing department’s total expenditure.